There’s a lot of noise out there about what an economic slowdown could mean for the housing market. And if it leaves you feeling a little uneasy, you’re not alone. But here’s the thing.

If you’re worried about what a potential recession could mean for the value of your home, or your homebuying power, your trusted REMAX® agent is here to help set the record straight. You don’t have to fear the market when you understand what the data actually shows.

A Recession Doesn’t Automatically Mean Home Prices Will Fall

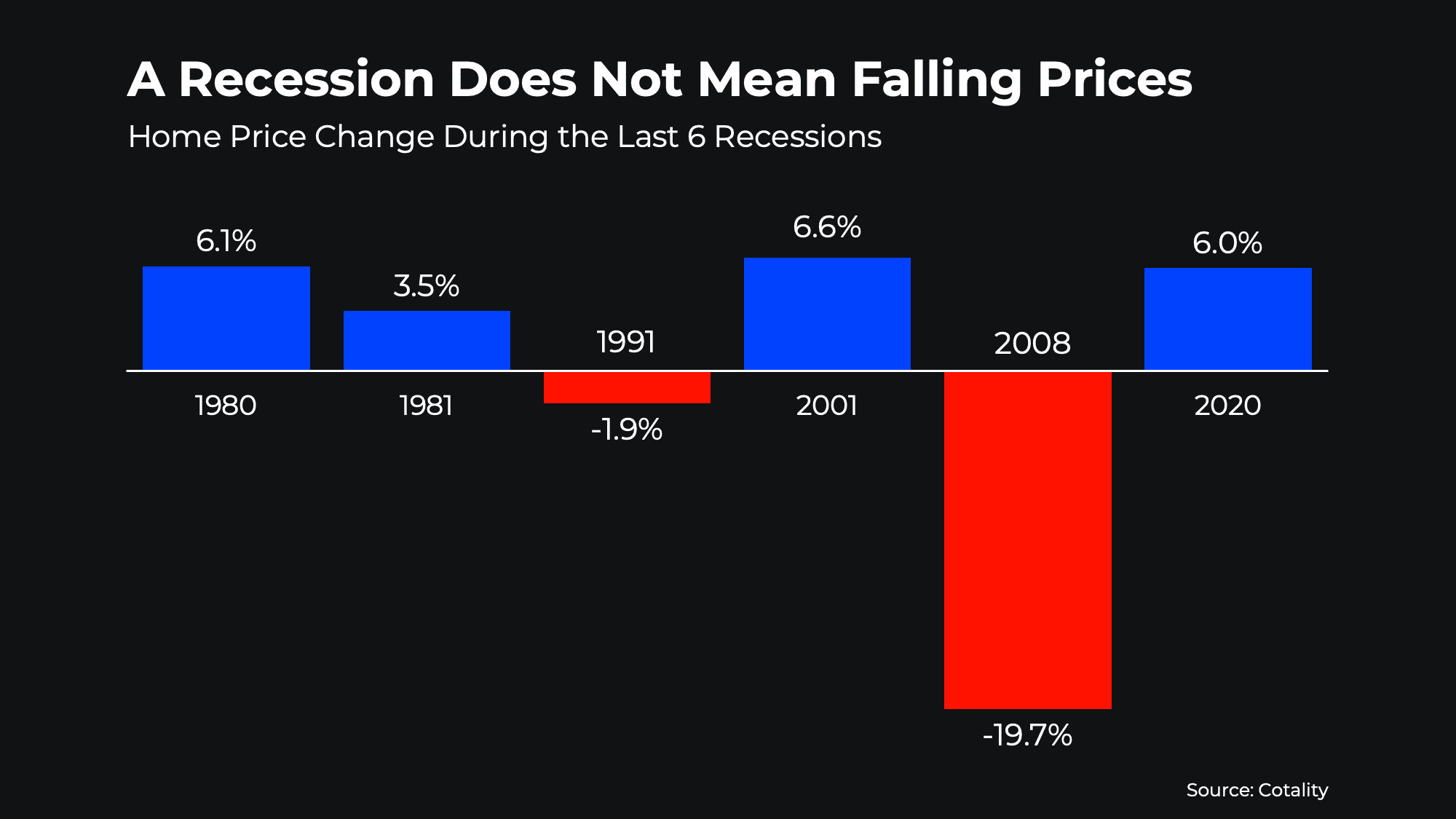

It’s easy to assume that if the economy slows down, home prices will fall. You might remember what happened in 2008. But the truth is: the housing crash of 2008 was an exception — not the rule.

It hadn’t happened before. And it hasn’t happened since. But what made 2008 so different? It was a flood of oversupply and very different lending standards. And everyone remembers how painful that time was.

Today, lending is much tighter, and even with inventory rising, the overall number of homes for sale remains well below normal levels. That keeps upward pressure on prices — and it keeps prices from falling significantly on a national level. And while prices are moderating in some markets today, a significant crash is unlikely.

In fact, according to data from Cotality, in four of the last six recessions, home prices actually went up (see graph below):

And since prices usually follow the path they’re already on, in most markets they should rise, not fall, in the days ahead. The rise just may slower, or even flat, but certainly not a crash.

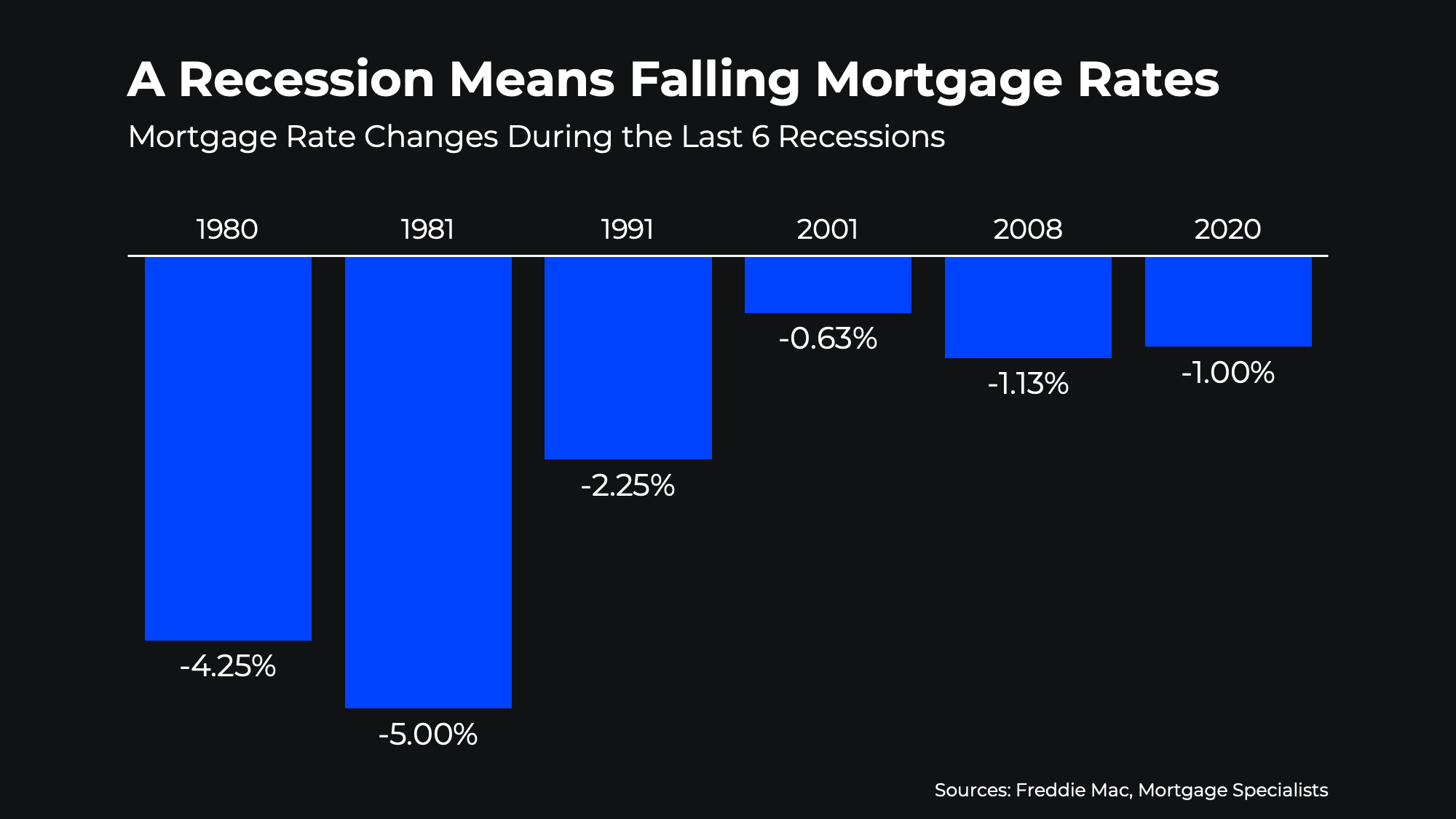

Mortgage Rates Typically Decline During Recessions

Another important pattern you should know? Mortgage rates usually fall when the economy slows down.

Looking at the data for the last six recessions, mortgage rates came down each time — helping boost buyer purchasing power, even during tougher economic periods (see graph below):

Bottom Line

Economic shifts are part of the cycle, but they don’t have to derail your plans to buy or sell a home. Don’t let fear be the thing that keeps you from your next move.

Instead, lean on facts to guide your decisions. And your trusted REMAX agent is the perfect person to make sure you have the information you need to feel confident moving forward.

Find Your Next Home

[showcaseidx_search submit_text=”Search Homes >>” margin=”8″ hide=”types”]

If you’re reading this late at night and want to start now, first send me an email, then focus on these items of the home buying process: 1) Download my Home Buyers Guide to learn general information (if you’re into doing your own research). 2) Talk to a quality mortgage lender and get pre-approved for financing. 3) Search for homes currently on the market to get a feel for the types of homes, locations, and price points available. 4) Read my Denver real estate blog (updated daily!) to further educate yourself about the market and relevant topics for home buyers. And of course, when in doubt, just call me and I will help you with each step of your journey.

Create Your Free MLS Home Search Account »

When It Is Time To Sell Your Home

My Denver real estate blog is updated daily with useful information for home buyers and sellers…

Real Estate Housing Market | Buying a Home | Selling a Home | Financing a Home | Renting | Homeownership | Investing

Hi, I'm

Hi, I'm