Is it Better to Own or Rent?

If you are trying to figure out whether renting vs buying a home is better for you, this page provides a lot of information to help you. It is quite common for renters to ask whether it is better to rent or own their home, so you are in good company. While there are some really good reasons to rent — such as, you do not plan to stay in your current general location for over 3 years — there are also many great reasons to own your home.

Please contact me — 303-242-8831 — and let’s discuss your options. Buying a home is often more attainable than people may think. And with the home value appreciation trend we have seen in the metro Denver area since 1992, buying sooner than later may have a big positive impact on your future. For instance, today’s home buyers are tomorrow’s homeowners and can experience the benefits of owning a home.

Rent vs Own: Consider The Financial Impact

Video: Rent or Buy a Home? Either way you’re paying a mortgage.

Impact on paying yourself versus paying your landlord

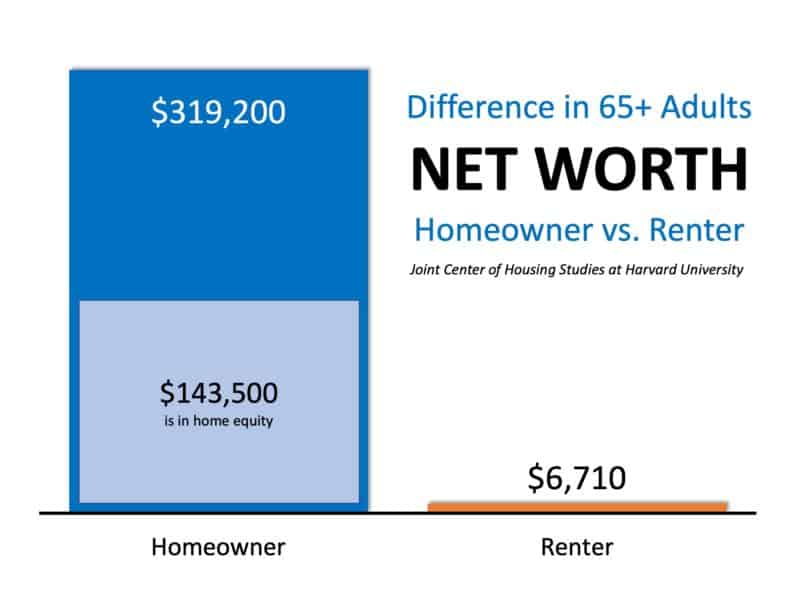

Check out this chart that shows how much rent may cost you. Your money is being used to pay down your Landlord’s mortgage instead of your own home mortgage. Imagine if you were paying down your mortgage, and as a result gaining equity with every monthly payment. It’s a form of forced savings that benefits you later in life. Landlords won’t write you a check at retirement; they’ve banked your money for their own benefit.

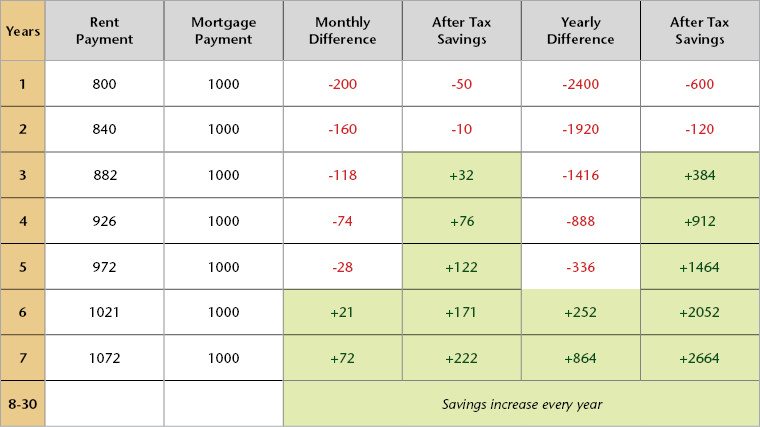

Example comparison for a renter and homeowner over 7 years

This chart shows a cost comparison for a renter and a homeowner over a 7-year period. The renter starts out paying $800 per month with annual increases of 5% The homeowner purchases a home for $110,000 and pays a monthly mortgage of $1,000. After 6 years, the homeowner’s payment is lower than the renter’s monthly payment. With the tax savings of homeownership, the homeowner’s payment is less than the rental payment after 3 years.

Rent vs Buy Calculator

This Buy versus Rent Calculator can help you get a sense of how renting a home and owning your home may affect your overall financial outlook over time. Of course, these numbers are approximations and will vary from your actual experience.

For a more in-depth understanding of how renting or buying your home affects your situation, please reach out to me. I am happy to share what I know and always treat the information shared with me with respect and confidence. This is about helping you find your best path forward, whatever that may be.

An Example Calculation

Below is a video from Salman Kahn on the economic considerations of renting versus buying, which highlights how important it is to run the numbers based on real world examples in the local real estate market. At times, it is cheap to buy in one part of the country and expensive to buy in another part of the country. In his example, he uses an interest-only loan calculation as a baseline example to show how much of a normal initial mortgage payment goes toward covering interest on the note.

Comparing Buyin Versus Buying a Home

Video: Renting vs Buying – Is buying a home always better?

Chart: Median Rental Rates Over Past 30+ Years

Chart: Homeowner vs. Renter Net Worth Comparison

List: Comparison Highlights of Renting vs. Owning a House

Chart: The Median Renter Across Markets

Median Renter: Share of Affordable Homes

Chart: Inflation-Adjusted Home Price Index

Interactive chart comparing Denver and other cities. Consider up/down markets & equity gained.

Renting vs Buying: List of Advantages and Disadvantages

| RENTING A HOME | Advantages | Disadvantages |

|---|---|---|

| Limited monthly costs | Landlord can sell property, resulting in you moving when you may not want to | |

| Not responsible for upkeep or repairs | Potential for annual rent increases | |

| Lower upfront costs | Limited or no ability to upgrade or remodel | |

| Able to relocate more easily | Paying your landlord’s mortgage, growing their equity instead of your own |

| OWNING A HOME | Advantages | Disadvantages |

|---|---|---|

| Fixed mortgage payment amount | Relatively large upfront cost | |

| Your house, your rules | Additional property expenses | |

| Remodel and make other permanant changes to property | Responsible for all repairs and upkeep | |

| More location security | Less flexibility if you need to relocate | |

| Each payment builds your equity (forced savings) | May cost you more than renting if you do not own the property for more than _3_ years | |

| Monthly payments may be the same or even less than a rental. | ||

| Ability to refinance loan to reduce monthly payments, reduce total interest to be paid, take cash out, etc. | ||

| Tax savings |

Video: Discussing pros and cons of renting and owning a home

Selected blog posts for Renters:

- Should I Buy or Rent a Home? Top Factors to Consider

- Home Ownership Perspective: Becoming Your Own Landlord

- 10 Things You Can Do as a Homeowner (That You Couldn’t as a Renter)

- Renting Out Your Old Home to Buy a New Home: Things to Consider

- Wow, Homeownership Really Does Impact Your Long-Term Finances

Recent blog posts for Renters and Buyers:

- Key Terms New Homebuyers Should Know [INFOGRAPHIC]

- Home Affordability is Affected by 3 Key Factors

- New Construction Homes Bring Much Needed Supply to Buyers

- Time to Move? Rightsizing Your Home For Retirement

- A Comparison of Renting and Buying a Home [INFOGRAPHIC]

- Grandparents are Moving Farther to be Near Loves Ones

- How Owning Your First Home Can Benefit You

- Build Wealth by Owning Your Home

- Metro Denver Housing Market – June 2023

- Your Tax Refund Can Help You Achieve Your Homebuying Goals

Economic Podcast: Rent vs Own

Hear from the First American Title economists on their take about buying vs renting a home in this podcast.

What do YOU think?

Please reach out and let me know your thoughts about renting vs buying a home.

Look for rental homes on the MLS…

Look into buying a home…

Frequently Asked Questions

Do I need to save up a 20% down payment before buying a home?

No. There are many options available and it is common for buyers to contribute 0%, 3%, 5%, 10%, or another amount for a down payment on a mortgage. Learn more about mortgages, mortgage rates, and lenders.

.

How much do I pay a Buyer’s Agent when buying my first home?

Potentially and most likely, $0. Many sellers commit before listing to pay both the Listing and Buyer agent commissions because it frees up buyers to put more money toward paying for the property — a win-win for the buyer and seller. Learn more about buying a home.

.

Contact Me

Here is an easy way to send me a quick message…

"*" indicates required fields