As reported by Odeta Kushi, Deputy Chief Economist for First American:

“Despite the federal foreclosure moratorium, there were fears that up to 30% of homeowners would require forbearance, ultimately leading to a foreclosure tsunami. Forbearance did not hit 30%, but rather peaked at 8.6% and has been steadily falling since.”

According to the most current data from Black Knight, the percentage of homes in forbearance has fallen to 7.4%. The report also gives the decrease in raw numbers:

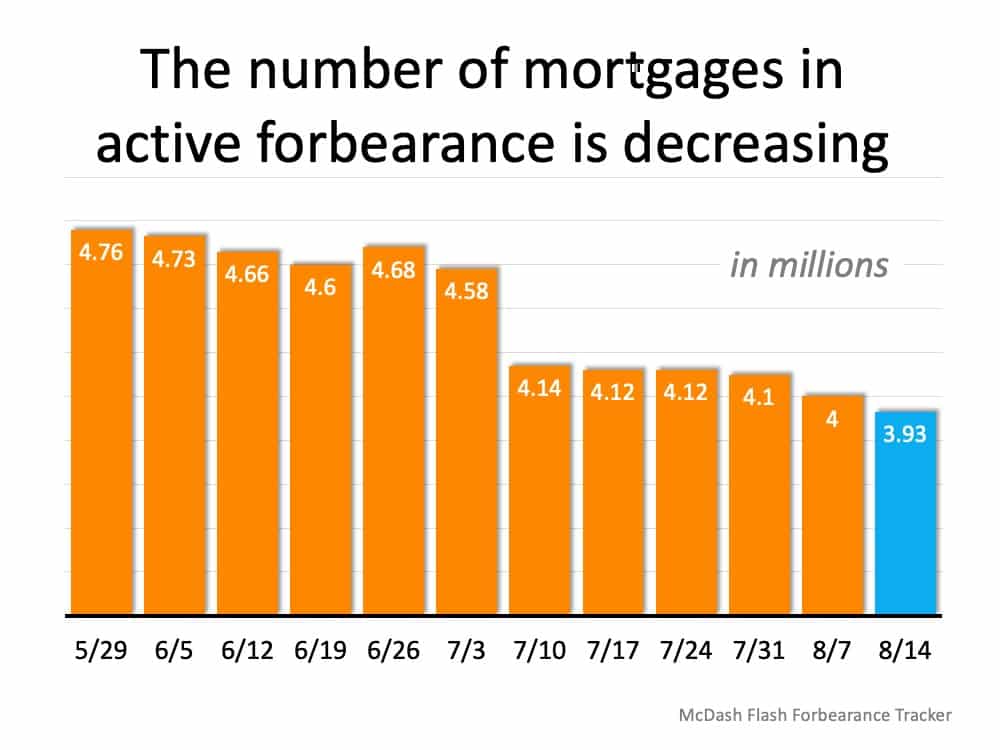

“The overall trend of incremental improvement in the number of mortgages in active forbearance continues. According to the latest data from Black Knight’s McDash Flash Forbearance Tracker, the number of mortgages in active forbearance fell by another 71,000 over the past week, pushing the total under 4 million for the first time since early May.”

Here’s a graph showing the decline in forbearances over the last several months:

What about potential foreclosures once forbearances end?

Kushi also addresses this question:

“There are two main reasons why this crisis is unlikely to produce a wave of foreclosures similar to the 2008 recession. First, the housing market is in a much stronger position compared with a decade ago. Accompanied by more rigorous lending standards, the household debt-to-income ratio is at a four-decade low and household equity near a three-decade high. Indeed, thus far, MBA data indicates that the majority of homeowners who took advantage of forbearance programs are either staying current on their mortgage or paying off the loan through a home sale or a refinance. Second, this service sector-driven recession is disproportionately impacting renters.”

There is one potential challenge

Today, the options available to homeowners will prevent a large spike in foreclosures. That’s good not just for those families impacted, but for the overall housing market. A recent study by Fannie Mae, however, reveals that many Americans are not aware of the options they have.

It’s imperative for potentially impacted families to better understand the mortgage relief programs available to them, for their personal housing situation and for the overall real estate market.

Bottom Line

If Americans fully understand their options and make good choices regarding those options, the current economic slowdown does not need to lead to mass foreclosures.

Start Your Home Search:

Starting the home buying process is easy and involves a few simple steps: Download my Home Buyers Guide to learn general information. Search for homes currently on the market to get a feel for the types of homes, locations, and price points available. And of course, please call me, or send me an email / text, to discuss any thoughts about your next home, the buying process, and the most important next step.

Beware of looking at new construction homes with a disadvantage. Builders are sophisticated sellers very capable of representing their own interests. Ask me about representing you at no cost to you.

Get My List of Hot Properties »

When It Is Time To Sell Your Home:

Find out how much your home is worth and download my free guide for home sellers for helpful information. It is important to choose a REALTOR® who can develop an effective marketing strategy for your property, negotiate well on your behalf, and has the knowledge to provide an accurate market comparison so you can determine the right asking price. The market is more balanced now and your asking price is an important component of your selling strategy. Contact me today to learn how your home stacks up against the competition and how we can position your property to sell quickly and for a good price.

My Denver real estate blog has loads of useful information for home buyers trying to figure out what they want to do…

Real Estate Housing Market | Buying a Home | Selling a Home | Financing a Home | Renting | Homeownership | Investing

Hi, I'm

Hi, I'm