You may have heard that mortgage loan pre-approval is a great first step in the homebuying process. But why is it so important? When looking for a home, the temptation to fall in love with a house that’s outside your budget is very real. … [Read more...]

Mortgage Forbearance Numbers During COVID Much Less Than Expected

Originally, some housing industry analysts were concerned that the mortgage forbearance program (which allows families to delay payments to a later date) could lead to an increase in foreclosures when forbearances end. Some even worried … [Read more...]

Mortgage Credit Availability Looks Very Different Today Than In 2008

Some are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008. One of the factors they’re pointing at is the availability of mortgage money. Recent articles about the availability of low down … [Read more...]

The Mortgage Process and What is Needed to Qualify for a Mortgage Loan [INFOGRAPHIC]

Some Highlights: Many buyers are purchasing homes with down payments as little as 3%. You may already qualify for a loan, even if you don’t have perfect credit. Your local loan professionals are here to help you determine how … [Read more...]

Here are the FICO® Scores Needed to Qualify for a Mortgage

It’s common knowledge that your FICO® score plays an important role in the homebuying process. However, many buyers have misconceptions regarding what exactly is required to get the loans they need. While a recent announcement from CNBC … [Read more...]

62% of Buyers Begin Process With Incorrect Assumption About Minimum Down Payments

Contrary to common misconception, a down payment is often much less than many believe. According to the ‘2019 Home Buyer Report’ conducted by Nerdwallet, many first-time buyers still believe they need a 20% down payment to buy … [Read more...]

Do Not Do These 7 Things After Applying for a Mortgage

Congratulations! You’ve found a home to buy and have applied for a mortgage! You’re undoubtedly excited about the opportunity to decorate your new home, but before you make any large purchases, move your money around, or make any big-time … [Read more...]

How a Mortgage Payment is Affected by Property Taxes

When buying a home, taxes are one of the expenses that can make a significant difference in your monthly payment. Do you know how much you might pay for property taxes in your state or local area? When applying for a mortgage, you’ll see … [Read more...]

Test Your Knowledge: Mortgage Down Payments

Whether you’ve owned a home before, or you’re ready to jump into homeownership for the first time, there are always a lot of questions swirling around about what is truly required for a down payment, and how to best source down payment … [Read more...]

The 2 Reasons Mortgages Require So Much Paperwork

When buying a home today, why is there so much paperwork mandated by the lenders for a mortgage loan application? It seems like they need to know everything about you. Furthermore, it requires three separate sources to … [Read more...]

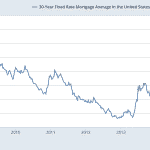

Mortgage Interest Rates Hit New 12-Month Low!

According to Freddie Mac’s Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at their lowest for 2019. Rates like these haven’t been seen since February 2018! Last week’s survey results … [Read more...]

10 Questions to Ask Your Mortgage Lender

When you're looking for a new house to buy, selecting a property is only half of the battle. You also want to be sure that you're choosing an excellent mortgage lender who will work with you to allow you to purchase the home you want, set … [Read more...]

Mortgage Loan Options for Homebuyers

As you get ready to buy your first home, it's easy to become overwhelmed by the mortgage loan options for homebuyers. The type of home mortgage you get will have a big effect on how much you pay now and over the lifetime of the loan. … [Read more...]

Mortgage Interest Rates are Increasing Fast for Home Buyers. Now What?

Let's first look at what is happening with mortgage interest rates? If you are actively looking to buy a home, then you probably already know that mortgage rates spiked upward in November. But if you are casually thinking about … [Read more...]